-

The spot price of PVC is stable, and the futures price rises slightly .09 07,2022

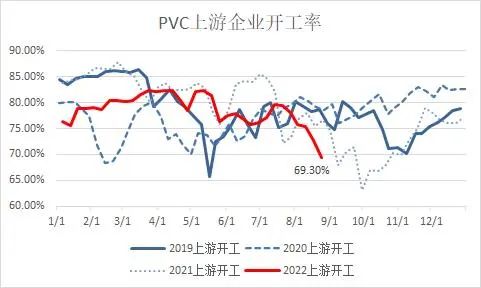

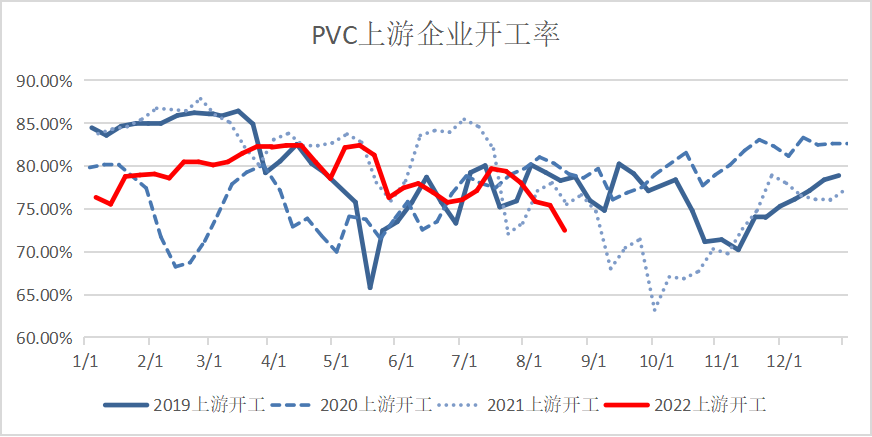

The spot price of PVC is stable, and the futures price rises slightly .09 07,2022On Tuesday, PVC fluctuated within a narrow range. Last Friday, the US non-farm payrolls data was better than expected, and the Fed's aggressive interest rate hike expectations were weakened. At the same time, a sharp rebound in oil prices also supported PVC prices. From the perspective of PVC's own fundamentals, due to the relatively concentrated maintenance of PVC installations recently, the industry's operating load rate has dropped to a low level, but it has also overdrafted some of the benefits brought by the market outlook. Gradually increasing, but there is still no obvious improvement in downstream construction, and the resurgence of the epidemic in some areas has also disrupted downstream demand. The rebound in supply may offset the effect of the small increase in demand under the transition from the off-peak season, which is difficult to bring to the inventory. enough optimizations. However, the price of calcium carbide has remained stable, the price in some areas has risen slightly, and the cost-side support has been strengthened. The current price of calcium carbide PVC enterprises has maintained a loss, and the current price is at a low valuation stage, and the short-term market pressure is relatively limited. In general, domestic and foreign macro downturn worries have intensified, and the demand side is currently insufficient to improve prices. However, the overall profit of external PVC mining companies maintains losses and the "Golden Nine Silver Ten" peak season is expected to make the disk in the short term. It remains to be seen whether demand can be effectively restored. In the short term, it is expected to maintain the trend of running at a low range and continue to pay attention to changes in demand.

-

U.S. interest rate hike heats up, PVC surges and falls .09 02,2022

U.S. interest rate hike heats up, PVC surges and falls .09 02,2022PVC closed down slightly on Monday, after Federal Reserve Chairman Powell warned against prematurely loosening policy, the market is expected to raise interest rates again, and production is expected to gradually resume as the hot weather is lifted. Recently, under the influence of the epidemic situation and power shortage in some areas, the production of PVC plants has been stopped and reduced. On August 29, the Sichuan Energy Emergency Office lowered the emergency response to energy supply guarantee for emergencies. Previously, the National Meteorological Administration also expected that the temperature in some high-temperature areas in the south would gradually drop from the 24th to the 26th. Some of the production cuts brought about may be unsustainable, and the high temperature power cut is not conducive to the demand side. In addition, some areas continue to be affected by the epidemic, and downstream demand has not improved. Although domestic demand is about to enter the seasonal peak season, the drag on the demand side is gradually slowing down, but the short-term improvement is not enough to bring about sufficient inventory optimization, and in the medium and long term, the demand increase due to the recovery of domestic demand is difficult to offset the supply side recovery. Incremental and external demand decreases under the pressure of recession, and the valuation of PVC continues to rise and still faces potential pressure. In general, due to the recent increase in supply disturbances, the previous situation of gradual easing of market supply and demand expectations will be temporarily broken, which will form a certain support for the disk price. At the same time, due to the fact that the comprehensive profit of external PVC mining enterprises maintains losses and superimposes the conversion of off-peak seasons, the disk surface presents a state of resistance to decline. In the later stage, if domestic demand recovers significantly, it will be conducive to the low-level rebound of disk prices, but if the recovery of demand is not as strong as the increase in supply, it will still face the pressure of accumulating stocks. Therefore, under the current game cycle of short, long and short, it is more likely to continue the trend of oscillating movement in the low range in the short term, and changes in demand are the focus of recent price changes.

-

A brief analysis of China‘s import and export data of paste resin from January08 29,2022

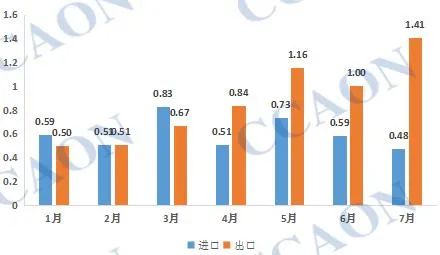

A brief analysis of China‘s import and export data of paste resin from January08 29,2022According to the latest statistics from the Customs, in July 2022, the import volume of paste resin in my country was 4,800 tons, a month-on-month decrease of 18.69% and a year-on-year decrease of 9.16%. The export volume was 14,100 tons, a month-on-month increase of 40.34% and a year-on-year increase An increase of 78.33% last year. With the continuous downward adjustment of the domestic paste resin market, the advantages of the export market have emerged. For three consecutive months, the monthly export volume has remained above 10,000 tons. According to the orders received by manufacturers and traders, it is expected that the domestic paste resin export will remain at relatively high level. From January to July 2022, my country imported a total of 42,300 tons of paste resin, down 21.66% from the same period last year, and exported a total of 60,900 tons of paste resin, an increase of 58.33% compared with the same period last year. From the statistics of import sources, from January to July 2022, my country's paste resin mainly comes from Germany, Taiwan and Thailand, accounting for 29.41%, 24.58% and 14.18% respectively. From the statistics of export destinations, from January to July 2022, the top three regions for my country's paste resin exports are the Russian Federation, Turkey and India, with export volumes accounting for 39.35%, 11.48% and 10.51%, respectively.

-

Boosted by interest rate cuts, PVC repairs low valuation rebound !08 26,2022

Boosted by interest rate cuts, PVC repairs low valuation rebound !08 26,2022The PVC rebounded higher on Monday, and the central bank's reduction of LPR interest rates is conducive to reducing the interest rate of residents' home purchase loans and the medium and long-term financing costs of enterprises, boosting confidence in the real estate market. Recently, due to the intensive maintenance and the continuous large-scale high temperature weather across the country, many provinces and cities have introduced power curtailment policies for high-energy-consuming enterprises, resulting in a phased contraction of the PVC supply margin, but the demand side is also weak. From the perspective of downstream performance, the current situation The improvement is not great. Although it is about to enter the peak demand season, the domestic demand is rising slowly, and some areas are temporarily stopped due to the high temperature. The short-term improvement is not enough to bring about sufficient inventory optimization. At present, the supply and demand margin of PVC itself is still loose. At the same time, the prices of crude oil and calcium carbide are weakened due to the loosening of the supply and demand margin. The weak demand superimposes the weak cost, which makes the price under pressure in stages. In view of the fact that the comprehensive profit of external PVC mining enterprises maintains a superposition of losses The peak consumption season is approaching, the support for the disk is still there, and the price may continue to fluctuate in the low range, but it does not change the expectation of the medium-term pressure trend. Changes in demand in the short term will be the focus of the near-term price turnaround, with continued focus on improving demand.